|

| Yes, we sell smaller houses too! |

It has been billed as one of the great American dreams;

owning your own home. We are fortunate

to live in a country were, yes, you can own private land and it’s “improvements”

(your house) without leasing the land

long term from the queen, Lord Grantham…………. ; you get the idea. But is it your best move? Maybe you should just rent? Who hasn’t heard of someone who bought their

first home in 2006 and couldn’t sell it in 2009! Here are a few tips & tests to

see if you’re ready to buy this year.

1.) If

you bought a house today, how long do you plan on staying there?

If you can’t tell me five years,

his may not be the year to buy your house.

The real estate market is very local (a micro market for you econ buff’s)

and is in constant motion. In my

experience, five years has typically been the point when you can sell and not

bring money to the table. It would also

have helped if you bought a home that needed a little work and you are

fortunate to have sweat equity.

2.) Look into your crystal ball and paint a

picture for me of what your life looks like in five years?

One of my favorite questions

because it usually gets a laugh, from the buyer. If you are looking at two

bedroom condo’s in center city and you’re telling me you expect to start a

family in two years, you are looking at the wrong house. More importantly, if you buy that condo and

you call me in two years to sell it, you are probably going to be disappointed with

what you will walk away with from the sale.

I love repeat business but …….

|

| Do us a favor? Click on the old lady and you will go to PBS. Think about giving them a donation. |

3.) To quote the Dowager Countess of Grantham,

“Oh good, let’s talk about money.”

How are you going to pay for your

house? Most buyers will need a mortgage, but what type, 20% down, FHA, 10%

down, PMI, appraisal, debt ratios!.........

Quickly, glass of red and a shot of Jamison. Deep breaths, in through the nose, out

through the mouth. It’s actually not

that hard. You will get pre-qualified

with a lender. It’s a simple process,

but there are a few traps to avoid. You

may contact my preferred lender, Bruce Hopkins at Waterstone Mortgage or any

other GOOD

lender.

What’s a good lender? One that does a lot of mortgages, so they

have lots of current experience, knows the area your buying in and is coming to

settlement. It can be very helpful if

your agent KNOWS the lender in question, so you have an advocate that can put a

little “leverage” on the lender should a problem arise. After all, your agent is going to be sending

them more business and they want your agent happy. Many mortgage brokers will tell you they do

their job right the first time and don’t need to come to settlement. @75% of

the time that can be true, but for that other 25% of the time it’s vital to

have them there to fix any problems.

Should you use the “agent’s”

lender, especially if they are in house (meaning the brokerage probably owns

them)? Having sold house for 20 years I

can honestly tell you at this point, I have worked with probably all of the

large brokerages in-house lenders and they mostly are fine. The additional fees are usually what separates

any mortgage company from good or bad.

There are many expected fees involved in buying a house. We want to see that they are in-line. If the lender is promising you an

unbelievable rate, that’s too good to be true, there is probably several fees

that will make it up to the lender.

FAIR WARNING – you will be pre-approved for more of a mortgage than

you will want to or probably should spend.

Keep in mind the cost of utilities, maintenance and a slush fund for

when the hot water heater brakes before that big dinner party. Most importantly know your budget. Ideally your housing should come in about 35%

of your monthly gross income. If your

credit is great and your job stable many lenders may push that to 50%; be very

careful here.

Can we look

at houses yet Carl, this is really boring?

NO!

4.) OK, paint me a picture of your perfect

house? Now toss it out the window and

tell me what your top three priorities are in the new house.

Don’t get me wrong, I do want to know what the perfect house looks

like. I just want to set the

expectations that it probably does not exist and you may need to be more

realistic about what you can afford and what the inventory is like, in the area

you choose to buy in.

5.)

My _____________________ (insert

parent, Uncle Fred, the guy on the subway) said I should only offer 50% of the

asking price, that the seller is desperate, that they’ll work with me, that my

agent is a crook, etc, etc, etc.

If the advice giver hasn’t bought a home in the last 6

months, they are misinformed. If it has

been 30 years their opinion may be outdated.

A good buyer’s agent (that would be my team) will be able to provide you

with the most recent comparable sales and if the average sold to list price

ration is 93% your 80% offer isn’t even going to be noticed. Keep in mind, that in the most popular areas

of the Philadelphia Metro region, homes are selling very quickly and in some

cases full price or more with multiple offers.

6.)

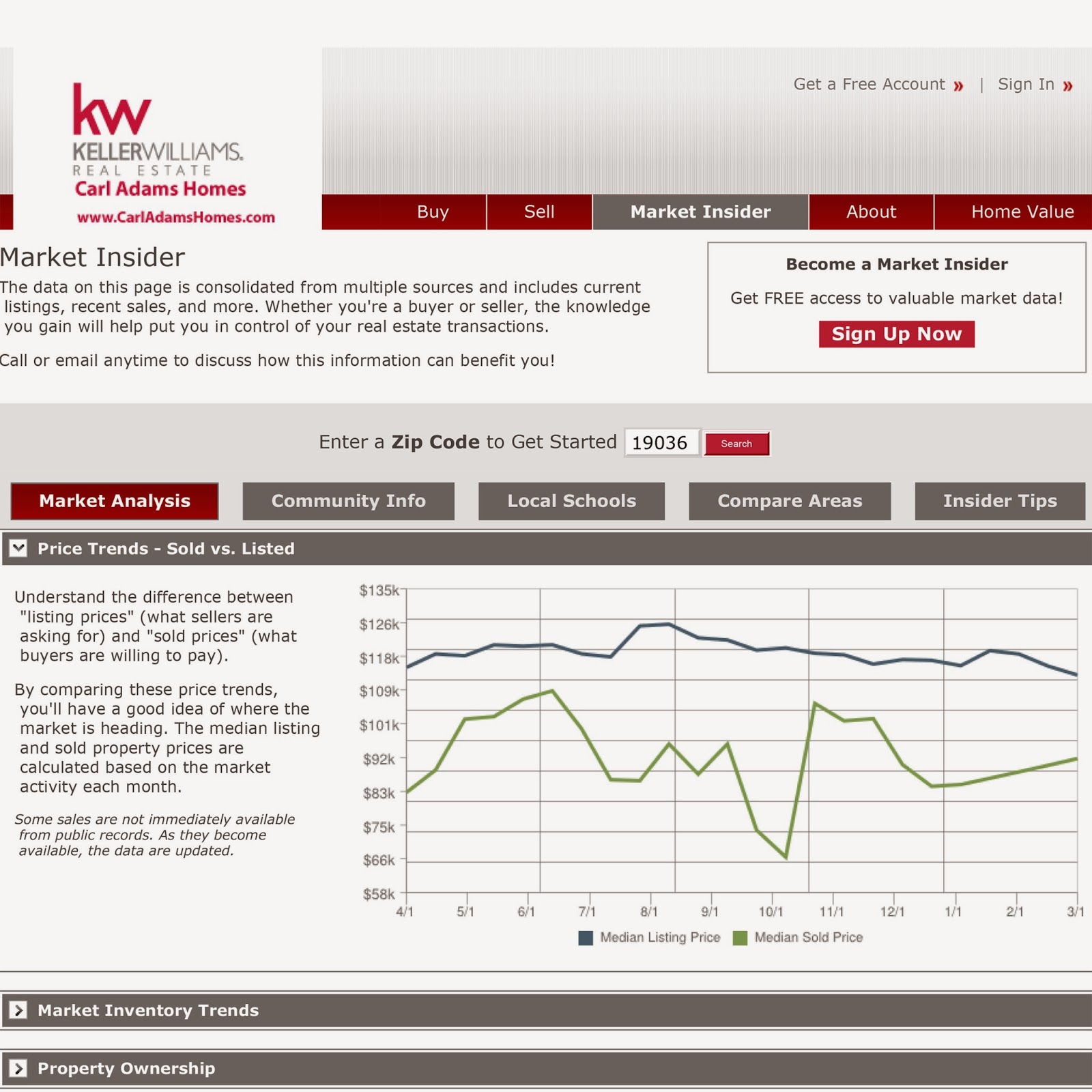

Get educated about the area you want

to live in and know the numbers.

Again, a good agent can help you with this. You should walk the neighborhoods on the

weekends, when the neighbors are out and about.

Go into the local stores, eat at the restaurants, check out the schools. How many homes sold in the last 6

months? How did that compare with last

year? What was the average and median

prices last year, 5 years ago and 10 years ago?

You could also click the link below and get a Market Insider Report for

the zip codes you are interested in –

OK, I’m tired of writing and this is

getting long winded (sorry, I’m Presbyterian).

Click the link below to go to my website and you can search all the

homes currently for sale in the region. Also below that is my mobile app, if

you would rather take it with you.

|

| CarlAdamsHomes.com |

No comments:

Post a Comment